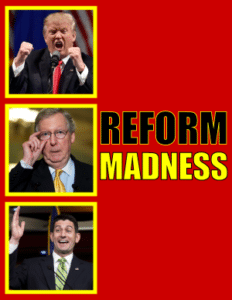

Republicans in the House and Senate (with the loud backing of President Trump) are rushing “tax reform” through Congress in a most disengenous and crass manner. The Senate and House tax measures would not reform anything. Indeed both bills would cause the federal budget deficit to soar, while corporate America and the super wealthy would receive outlandish tax cuts. The nonpartisan Congressional Budget Office on Nov. 8 issued a score of the House Republican tax bill showing that it would add $1.7 trillion to the national debt over 10 years.

Republicans in the House and Senate (with the loud backing of President Trump) are rushing “tax reform” through Congress in a most disengenous and crass manner. The Senate and House tax measures would not reform anything. Indeed both bills would cause the federal budget deficit to soar, while corporate America and the super wealthy would receive outlandish tax cuts. The nonpartisan Congressional Budget Office on Nov. 8 issued a score of the House Republican tax bill showing that it would add $1.7 trillion to the national debt over 10 years.

While health and other social services programs are not (currently) included in the tax cut bills, the ballooning of the national debt will provide momentum for Republicans’ never-ending goal of drastically cutting domestic social safety programs like Medicaid, Medicare and the Affordable Care Act. Despite their enormous addition to the deficit through these tax cuts, these politicians will quickly shift their focus and proclaim the national debt must not be foisted on hapless future generations so they need to slice and dice Medicaid and other programs to cut the deficit.

The tax bill is already an immoral give-away to corporations and the uber wealthy during times of growing income inequality and strong national economic growth. That economic growth, as evidenced by the ever-rising stock markets, however, has completely benefited the top earners and corporations. Therefore, without a significant re-focusing on low and middle-income individuals, the tax bills are the wrong medicine for these times. The proposed tax cuts will only exacerbate the economic inequalities that harm the vast majority of the country, and in particular cruelly hitting people of color, women, low-income individuals and other vulnerable populations the hardest. President Trump, his cabinet members, and many Republican Congressmen, however, will greatly benefit financially, reaping great rewards from this “cut, cut, cut” bill.

Beyond pushing nonsensical economic policy of giving more tax breaks to corporations and the super wealthy, the Republicans’ tax “reform” efforts currently go even further with rollbacks of federal tax provisions vital to people with disabilities, immigrants and students. The Consortium for Citizens with Disabilities notes that the House tax bill would end both the medical expense deduction for individuals, and disabled access tax credit for corporations, which are vital for people with disabilities to afford services, supports and continuity of those services. U.S. Senator Bob Casey (D-Pa.) has also warned that the “Republican tax scheme” would especially harm the elderly and people with disabilities.

“Whether it is the employment of people with disabilities, the cost of out-of-pocket medical expenses, or making the country’s businesses accessible to older citizens and people with disabilities, the Republican tax scheme will make it more costly and more difficult for older adults and Americans with disabilities to live prosperous, independent lives.” Casey says.

Sadly, and perhaps not surprisingly, Republicans are also using the tax bills to harm immigrant individuals and families. The House tax bill, for example, would adversely alter the Child Tax Credit (CTC) for children in low-income immigrant families. The National Immigration Law Center says the provision would deny the CTC “to more than five million children – 4 million U.S. citizens and the rest young ‘Dreamers’ – whose parents are undocumented. The CTC alone lifts 1.5 million children out of poverty every year and mitigates poverty’s impact for millions more.”

Trump and some of his allies in Congress are also threatening to include a repeal of the Affordable Care Act’s “individual mandate,” the health care law’s provision requiring everyone to have health care insurance. The individual mandate insures a robust marketplace for those enrolling in the ACA because healthy people are incentivized to buy coverage to avoid paying a tax penalty and insurers need healthy people to balance out those who may incur high medical costs in any given year. Republicans claim that repealing the ACA’s mandate would help offset the new tax breaks. The latest nonpartisan Congressional Budget Office score says that destroying the mandate would save a bit more than $300 billion, so in reality hardly enough to cover the enormous debt the Republicans’ tax scheme envisions.

These tax bills are more than a lame throwback to the 1980s; they are a part of the Republicans’ re-envisioned and wildly out-of-touch austerity agenda – tax cuts for wealthy, tax hikes for the middle class, and cuts to social foundation programs like Medicaid.

The tax cut efforts must be defeated because of the harm they would inflict on all individuals, especially low-income individuals, immigrants and people with disabilities who will have to pay higher taxes when they lose current deductions. The tax bills must also fail because of the drastic harm they would cause to Medicaid, Medicare and other social service programs in the future when Republicans return to being deficit hawks, looking to address the swelling federal deficit caused by their reckless and self-serving tax breaks.